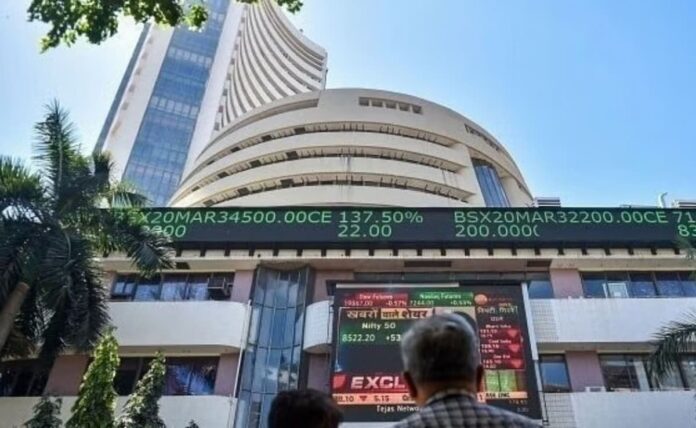

The Sensex slipped by more than 200 points on Wednesday as weak global cues and profit-booking across major sectors weighed on investor sentiment. The benchmark BSE Sensex closed at [insert approximate figure if needed], down over 200 points, while the NSE Nifty 50 also registered a modest decline.

Analysts attributed the fall to cautious trading ahead of key global economic data releases. Weakness in Asian and European markets further added pressure, as concerns over global inflation, geopolitical tensions, and subdued corporate earnings kept investors on edge.

Heavyweights in the banking, IT, and metal sectors were among the top drags. Shares of major lenders and technology firms saw mild corrections after recent rallies, prompting traders to lock in profits. Metal stocks, sensitive to global commodity cycles, also retreated following softer demand signals from international markets.

Midcap and smallcap indices mirrored the broader decline, though losses remained limited due to selective buying by domestic investors.

Market experts believe the current dip is part of a short-term consolidation phase rather than a trend reversal. “Given the ongoing global uncertainties, volatility is expected. However, India’s macroeconomic fundamentals remain strong, which should support markets in the medium term,” said market strategist Anuj Kapoor.

Investors will now be closely watching upcoming U.S. inflation data, crude oil price trends, and domestic corporate announcements for clearer market direction.

Despite today’s drop, analysts remain optimistic about long-term market prospects, citing resilient economic growth and steady foreign institutional investor inflows.